Investing in rental properties is a proven way to build long-term wealth, but the key to success lies in finding properties that actually cash flow—meaning they generate positive monthly income after all expenses. Many new investors buy properties based solely on appreciation potential, only to discover they’re losing money month after month. If you want to avoid that trap, here’s how to find rental properties that truly put money in your pocket.

1. Understand Cash Flow Basics

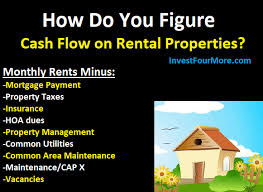

Cash flow is the money left over after you pay all the expenses associated with a rental property. These include mortgage payments, property taxes, insurance, maintenance, property management fees, and vacancy costs. Positive cash flow means the rental income exceeds these expenses, providing you with steady monthly profits.

2. Choose the Right Location

Location is everything in real estate investing. Look for areas with strong rental demand, such as cities with growing job markets, universities, or military bases. Neighborhoods with low vacancy rates and rising rents are ideal for cash flow. Research local rental rates and compare them to property prices to ensure the numbers make sense.

3. Crunch the Numbers Carefully

Don’t rely on gut feeling or estimates. Use a detailed cash flow analysis to calculate:

- Expected monthly rent

- Mortgage payment (including interest and principal)

- Property taxes and insurance

- Maintenance and repair costs

- Property management fees (if applicable)

- Vacancy allowance (usually 5-10% of rent)

Make sure the rent covers all these expenses and still leaves you with a profit.

4. Look for Value-Add Opportunities

Sometimes properties with below-market rents or cosmetic issues offer better cash flow potential. Renovating or improving these homes can allow you to raise rents and increase cash flow over time. However, factor renovation costs carefully to avoid overspending.

5. Consider Multifamily Properties

Smaller multifamily units, like duplexes or triplexes, often provide better cash flow than single-family homes because you have multiple rental incomes supporting one mortgage. This can reduce your risk and improve overall profitability.

6. Use Professional Help

Work with experienced real estate agents, property managers, and lenders who specialize in investment properties. Their insights and connections can help you find better deals and avoid common pitfalls.

Conclusion

Finding rental properties that cash flow takes time, research, and discipline. By focusing on strong locations, conducting detailed financial analysis, and seeking value-add opportunities, you can build a profitable rental portfolio that generates steady income for years to come.